Note

This article was automatically translated using Google

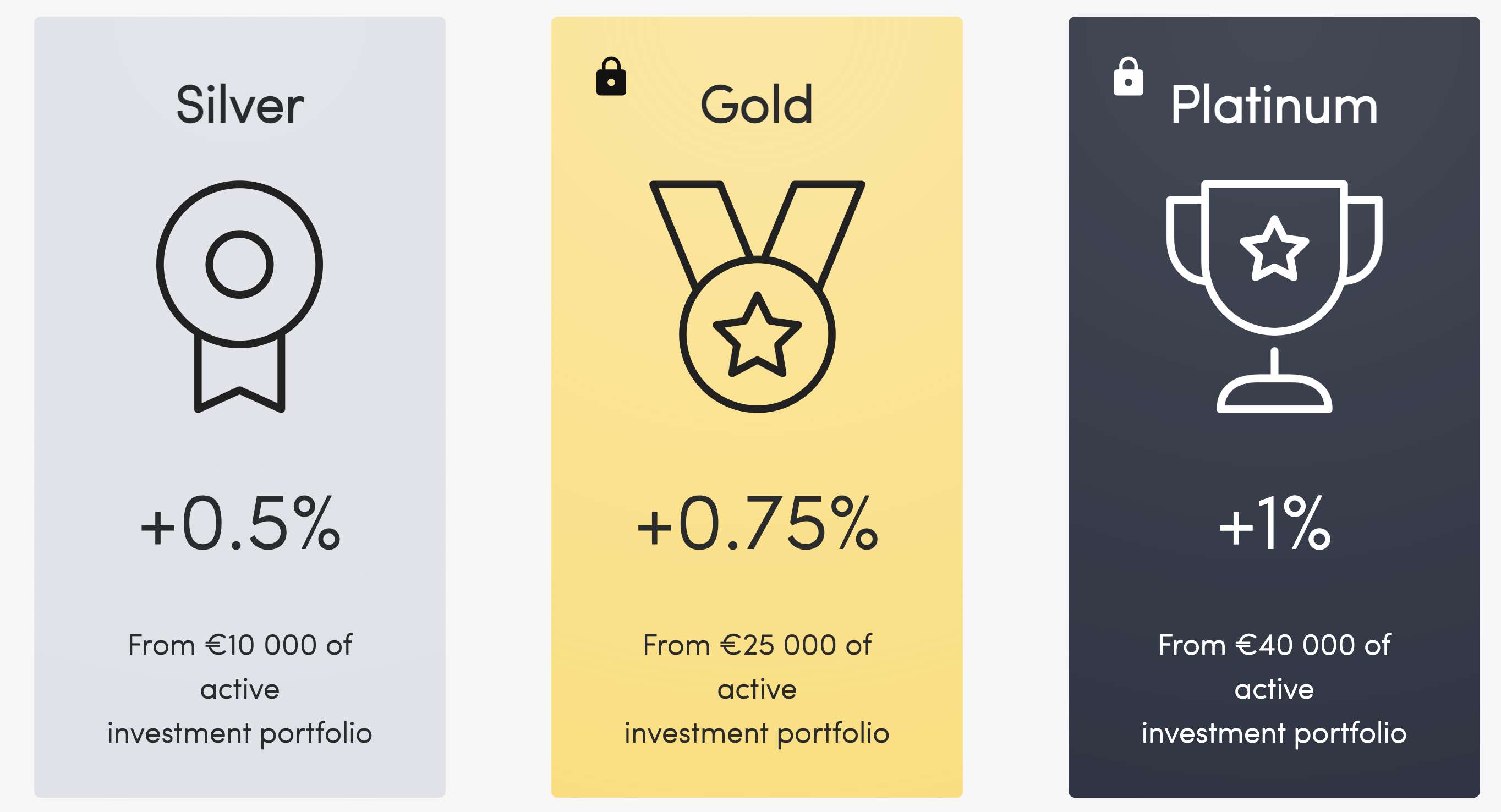

Today I want to share a p2p investment platform that has been used for nearly two years. It promises an annualized return of more than 10%. In my experience, it is more than 11% per year. In addition, it also provides financial incentives. The activated investment will be 10,000/255,000/40,000 euros, which will add an additional 0.5%/0.75%/1% income bonus.

Peerberry is a multi-lender P2P investment website located in Riga, Latvia. It was launched in 2017 and has been rapidly developed since then. Peerberry was originally owned by Aventus Group and only provided its own loans on the website. Since then, the business has been acquired by a new set of shareholders, and new lenders have been added to the site. Here is an interview with his new CEO Arūnas Lekavičius. In foreign countries, whether an investment platform is reliable depends on three main points: 1. Capital guarantee; 2. System regulations; 3. Investment team

The use of the Peerberry investment website is very simple to use. It has a function that allows investors to choose personal loans in major markets or use automated investment tools. **Currently there is no secondary market. **However, we don’t think this is a problem because most loans currently have a maturity date of only 1 month.

The automatic investment feature has all the usual options found on other sites. This includes the country, loan term, interest rate and loan originator. Peerberry provides investors with an email every week, which provides simple information about the interest earned, the principal received from the investor, the investment made, and the cash held on their behalf. The website has a good reporting function that allows investors to view all activities on their account within a selected period of time, and can generate tax forms.

Automatic investment is very convenient. I often communicate with their customer service to optimize the investment algorithm. At the same time, it includes the UI design and convenience of manual investment. Their quick feedback and fix will make me feel more at ease.

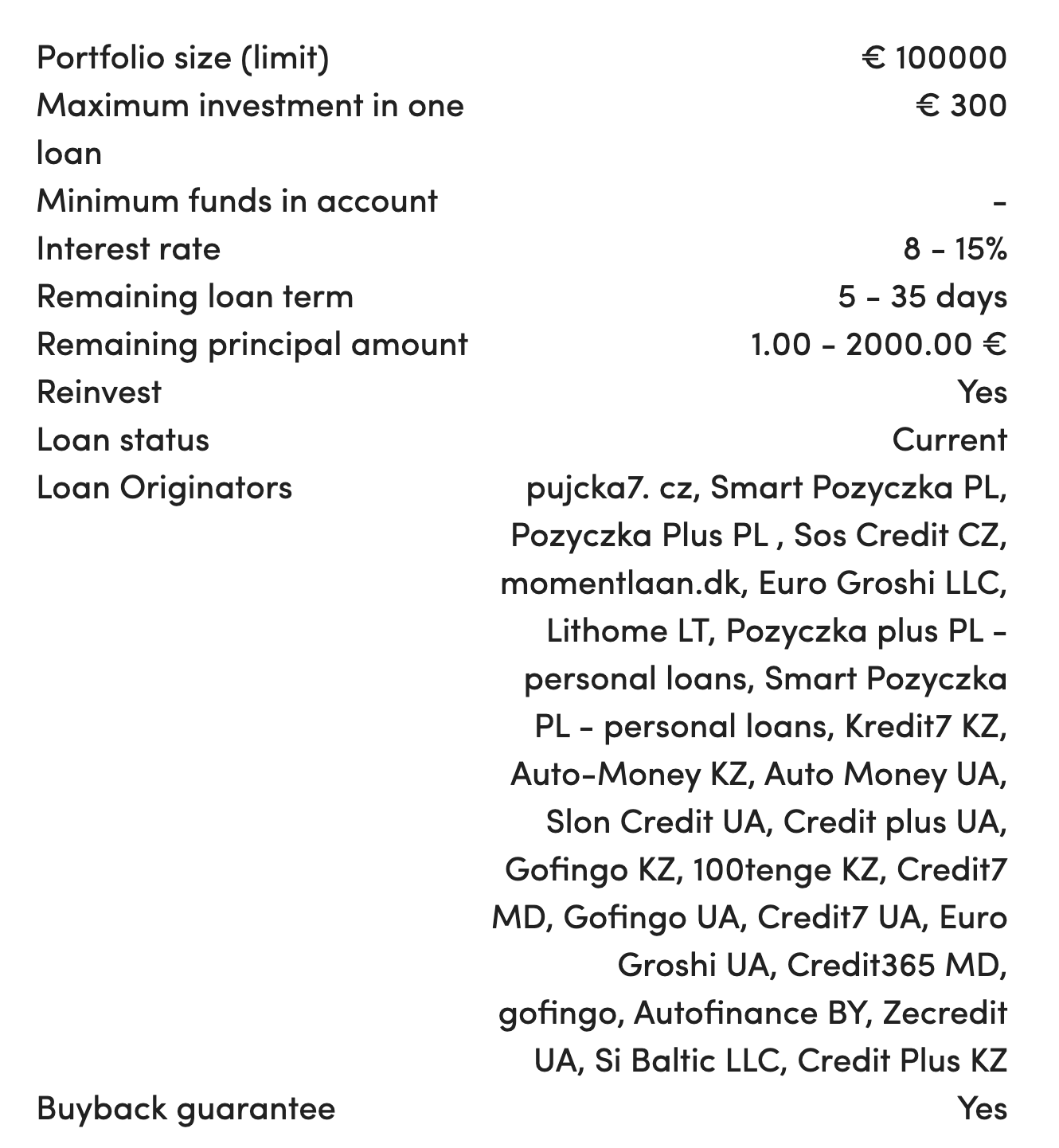

Interest rate is usually around 11-12%, but it can reach up to 15%. Most loans are short-term loans with repurchase guarantee. It mainly includes personal loans, daily loans, auto loans and development loans. Recently they have opened bridge loans, but the cycle is generally about 12 months, so I did not choose.

I like the point

- High interest rate-usually 11% to 12%, and the cycle is very short (I set the automatic investment from 5 days to 35 days, and the single amount does not exceed 300 euros, which can greatly avoid risks)

- Design one of the best P2P websites. Simple, beautiful and practical design

- Peerberry has recently started adding new lenders, which will provide diversified opportunities

- Most loans have repurchase guarantees. If the loan is overdue for more than 60 days, the lender will repurchase the loan and pay the principal and interest

- The website is available in English, German and Spanish

- Loans have performed well so far-not many loans have been repurchased due to default

- The management team is willing to listen to feedback and provide good communication (almost every question will be answered within two days, including the use of feedback and overdue investment questions)

question

- The website is very popular among investors, and most people will choose automatic investment, so if your automatic investment settings are too strict, there will be some funds that cannot be automatically invested, so keep logging in once every two weeks to check and compare Well, they have recently developed an app that can be used, which is more convenient, but maybe because they use some google code, if they are used in China, they have to climb the wall.

- Some countries have higher risks, such as Moldova, Kazakhstan and Russia. I basically don’t vote in these countries

Risks and benefits

Since most loans on Peerberry come with repurchase guarantees, it is important to know the financial status of each lender. Peerberry has recently made great improvements in this area because it provides business updates for each loan originator and also shares other financial information.

The Aventus Group achieved a net profit of more than 12 million € in 2019. My suggestion is to allocate the investment as much as possible to the lenders of the Aventus Group operating in Poland, because I think the country’s risk is lower than other countries (such as Kazakhstan) And Ukraine). Some of the Aventus Group lenders that appeared on Peerberry are very new and small. In most cases, these companies will benefit from collective guarantees, which makes their risk lower than in other cases.

Another major loan group is called GoFingo. It is a small loan group with a combination of new and established loan businesses. At the beginning of 2020, Peerberry announced that GoFingo had achieved a net profit of approximately 2 million euros in 2019.

What is the profitability of the Peerberry platform itself? CEO Arunas Levkavicius said that the company achieved meager profits in 2018 and 2019. He pointed out that the business has invested heavily in marketing, technology and staffing. Given that the platform is still in a relatively young stage, we think this is a good performance, and there is no need to worry about the feasibility of the platform as an enterprise.

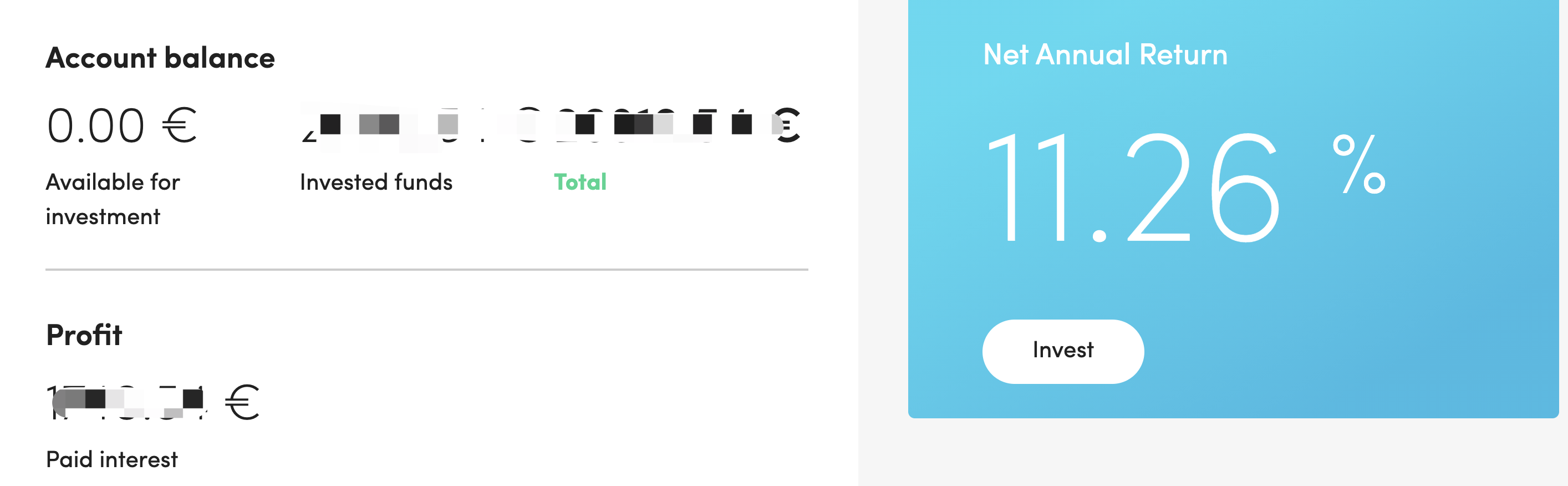

In general, I think the interest rate provided is appropriate. Based on my own two-year experience, the annualized return has basically remained above 11%.

An epidemic has caused everyone to be anxious, and income after going to bed has become a hot topic. Imagine it. The minimum housing price in domestic first-tier cities is more than 5 million yuan, and the average rent of 5 million houses is 5,000 yuan a month, and the yield is only 1.2%. And if you put out 5 million for long-term investment, you can use 10% to calculate 500,000 per year. If you rent all of it, what kind of house can you live in? And if you work, can you earn 500,000 a year? So I always advise people around me that buying a house now is really…

If you want to invest and have Euros, then click here to get started

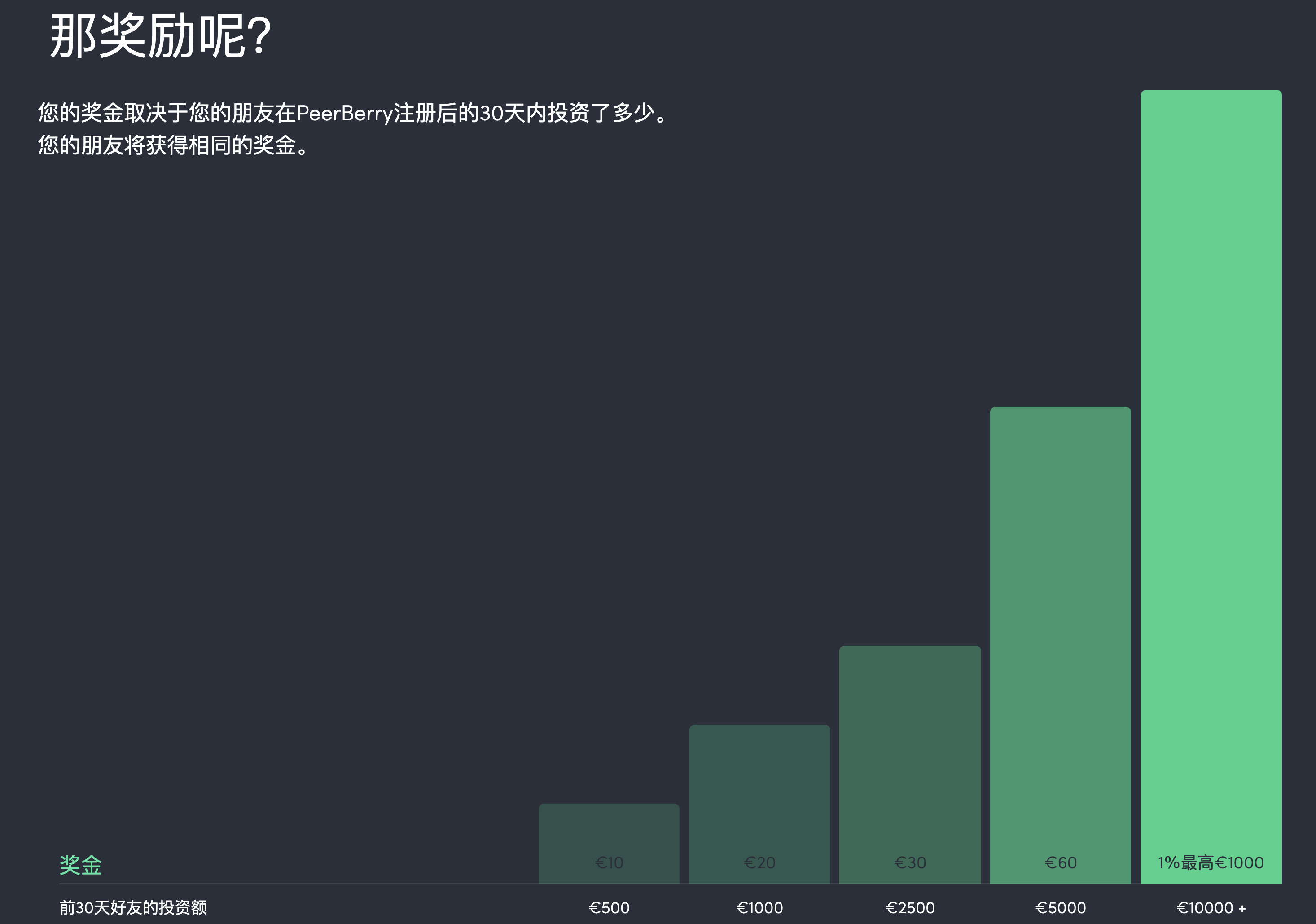

It should be noted that you will receive a bonus for registering investment through the link above. The bonus depends on the amount of investment in the first month, and I will also get the corresponding amount. If you don’t want to give me these bonuses, you can also click here register directly.